Volume 41 | Issue 12

Download this FYI Roundup as a printable PDF

It’s time to take a look at some of the most recent surveys and reports providing insight into trending HR and employee benefits issues that employers should keep in mind heading into the new year. In this issue we focus on compensation, including executive compensation; financial security; retirement planning; health and welfare; and an array of HR issues relevant to workforce, engagement, and talent management practices. This issue also features the latest surveys available from Conduent HRS Consulting.

Our Latest Surveys

Three new surveys from our Market Assessment and Survey Intelligence team take on some of the issues companies are thinking about as part of adapting to the needs of a changing workforce. Data on financial wellness offerings, flexible work arrangements, and staffing ratios is examined and analyzed, offering relevant insights for the new year.

2017 Financial Wellbeing and Voluntary Benefits Survey – Looks at the increasing focus on financial wellness and evaluates the ways in which employers can create a voluntary benefits package that helps employees achieve greater financial security. This survey found that voluntary benefits are now solidly mainstream, particularly with large employers, and that most plan to expand their offerings in the coming years. With employee financial wellbeing considered an important factor in company performance, employers are increasingly integrating targeted financial wellness offerings into voluntary benefits packages.

2017 Virtual Workplace Survey – Reviews the perspectives and practices of HR professionals and company leaders regarding flexible work arrangements, including flexible scheduling and working from home. This survey looks at the various reasons employers have chosen to implement such policies, and the resulting impact on the organization. The survey also examines the types of support and conditions needed when offering flexible arrangements, and indicates the functional areas and job categories most likely to be excluded from such arrangements.

2017 Functional Staffing Ratios Survey – Provides an analysis of compiled data from 36 U.S. companies on staffing ratios across 15 functional areas. By comparing the number of employees at various levels within an organization, this survey offers insight into departmental and organizational efficiency, which employers can use as part of their own planning.

Conduent HRS Consulting

For more information about Conduent HRS Consulting Surveys, contact Anwar Aguilar.

Compensation

Compensation continues to be one of the driving forces behind recruitment, retention, and engagement. Several new reports look at general trends in wage growth, the impact of employee perceptions about wage fairness on engagement, and the significance of salary on recruiting in the healthcare industry.

ADP Workforce Vitality Report – Looks at wage growth across all industries, tracking the same set of workers over time. The report concludes that workers who switched jobs to enter the service industry experienced the greatest wage growth, and among those who did not change jobs, information industry workers had the highest wage gains. (ADP, 2017)

Employee Engagement: The Formula for a WINNING Culture – Looks at how perception is more important than reality when it comes to employee satisfaction and engagement. The report finds that when employees feel appreciated and believe that pay is fair and transparent, whether the pay is actually fair relevant to the market, it is less important. (Payscale, 2017 – Note: registration required to download the report)

The BDO 600 – 2017 Survey of CEO and CFO Compensation – Reviews compensation of CEOs and CFOs at 600 mid-market publicly traded companies to compare practices based on company size and industry. The survey also examines trends over time, and the proportion of equity versus cash compensation. (BDO, 2017– Note: registration required to download the report)

2017 Director Compensation Report – Provides extensive review of director compensation at 300 companies across multiple industries and sizes. The report includes data for total cash compensation, equity award types, committee compensation, deferrals, and stock ownership guidelines. (FW Cook, 2017)

Employee Benefits

Several new reports look at employee benefits from various angles, offering insights for employers who want to keep up with the rapid changes in today’s workplace. Topics covered include the trends toward a global benefits strategy, suggestions for creating the most comprehensive benefits package to attract talent and address the needs of a diverse workforce, and tips for helping employees connect the value of benefits to a longer-term sense of security.

Global Employee Benefits Watch 2017/2018 – Examines some of the important trends in HR and employee benefits on a global level. This survey of over 400 HR professionals and 2,000 employees in multiemployer organizations found a shift from an emphasis on rewards to one that focuses on experience, such as wellbeing and a better workplace environment. The importance of a global benefits strategy is also emphasized, as is its alignment with an organization’s people strategy. Other issues examined include the trend towards HR shared service centers, and the need to digitize benefits administration. The survey also looks at changes in communication initiatives, and the rise of analytics. Extensive comparative data is provided, offering some benchmarks for employers who want to keep up with global trends. (Thomsons Online Benefits, 2017 – Note: registration required to download the report)

2018 Employee Benefits Survey – Provides four recommendations on putting together a comprehensive benefit package to attract and retain top talent and ensure employee satisfaction. Although the report focuses on challenges faced by smaller business, the takeaways are useful for any company. The report states that the most critical benefits an employer should offer are vacation time, health insurance, maternity/paternity leave, and retirement planning. Health insurance in particular is an important benefit, with 55% of employees citing it as the most valuable benefit they receive, as compared to 18% citing vacation time. Cafeteria style benefits that can address the needs of a diverse workforce are recommended as the best approach, giving employees a greater sense of choice. (Clutch, 2017)

Hopes, Fears, Dreams…and Employee Benefits – Looks at some of the biggest issues important to employees, and explores ways that employers can educate them about the value of benefits in being able to reduce stress and achieve a sense of longer-term security. The report offers some suggestions on how to do this: clearly communicate the fundamental components of benefits; offer a variety of ways for employees to obtain benefit information; and develop an understanding of employee needs based on characteristics other than demographics, such as emotions and values. (Lincoln Financial, 2017)

Financial Wellness

Employee financial security impacts the workplace in numerous ways, and an array of new reports look at some of the factors influencing approaches to budgeting and saving. The relationship between financial wellness and budget management is examined, along with the usefulness (or not) of financial education programs. Differences in savings and investment behavior across the generations, and insights into the financial security concerns of middle class African Americans, round out some of the latest research offerings.

Four Trends Making Budgeting More Important Than Ever – Examines some recent trends that show how important budget management is for financial wellness. The report looks at the impact of social media on consumer spending, including the influence of customized marketing and peer behavior. Other trends include the shift to a cashless society, with credit cards and mobile payments making it harder to gauge the true impact of spending. The increasing disparity between income and the costs of housing and college tuition is another reason budgeting is important, as is the trend towards a contingent workforce, with employees shouldering greater healthcare and retirement costs. (Prudential, 2017)

So Many Courses, So Little Progress: Why Financial Education Doesn’t Work – And What Does – Looks at the effectiveness of education on improving employee financial wellness. This analysis of over 200 studies found that financial education is effective in only .001% of cases. By looking at the history of financial education, the relevance of behavioral economics, and the kinds of interventions that work and do not work, this report is useful for companies looking for ways to improve employee financial wellness. (Questis, 2017)

How Millennials, Gen-Xers, and Baby Boomers Save and Invest – Investigates the attitudes, behaviors and financial goals of three different generations in the workforce. This survey compares savings and investment goals, factors influencing the performance of investments, reasons for investment confusion, specific investment vehicles used, gender differences in investing, and use of advisors. (BMO Harris, 2017)

Health and Welfare

Healthcare costs and uncertainties continue to dominate concerns into the new year, but a new survey shows that overall employer and employee experience is positive. Two other reports examine the impact of stress on both the physical and mental health of employees, and explore effects on the workplace.

Employers Hold Steady in Time of Uncertainty – Looks at the rate of healthcare benefit offerings by employer in light of current uncertainties about healthcare legislation, including potential repeal of the mandate. The survey of over 1,500 employee benefits decision-makers found that the majority of both employers and employees were happy with their health insurance benefits, and that although the cost was a concern to employers, most were working to keep employee costs down. When asked what they would do if the mandate was repealed, the majority of employers would either do nothing, increase coverage, or evaluate coverage options. (Transamerica Center for Health Studies, 2017)

Consumer Health POV 2017 – Explores the factors related to employee wellbeing, including health priorities, stress triggers and eating habits. The survey asked 2,000 full-time employees across a range of demographics about their stress levels, self-perceived resilience, and dietary habits, finding that 92% of respondents reported experiencing stress and 88% had trouble following a healthy diet. (Welltok, meQuilibrium and Zipongo, 2017 – Note: registration required to download the report)

Mind the Workplace – Looks at the effect of workplace stress on mental health and the impact it has on employee engagement. The survey found that an unstable or unsupportive workplace led to increased distraction at work, increased absenteeism, and greater job dissatisfaction. Industries with the healthiest scores included health, financial services, and nonprofits, with the lowest scores being in manufacturing, retail, and the food and beverage industry. (Faas Foundation/Mental Health America, 2017)

HR – Workforce

New research into workforce issues focuses on leadership challenges as three generations come together in the workplace, as well as the top trending issues for 2018, including competitive wages, STEM skills and analytics. Other reports include an investigation into the primary concerns of hourly workers, and how to achieve successful disability management to sustain and increase productivity.

2017 State of the Hourly Worker Report – Looks at the demographics of hourly workers, what their wants and needs are, and issues related to the hiring process. The survey finds that Millennials make up the bulk of hourly workers, with 42% not making enough money to cover monthly expenses. 89% are looking for a new job, and most of them prefer full-time work. Other findings include the increased focus on social media and mobile searches to find positions, with the a lack of employer response being the most frustrating aspect of the job search. (Snagajob, 2017 – Note: registration required to download the report)

Six Workforce Trends That Will Dominate 2018 – Lays out some predictions for the top workplace trends for this coming year. Strong pay packages and flexible work options are two of the hottest trends, with the need to counter wage stagnation and accommodate employee demands for flexible scheduling continuing to be key factors in attracting top talent. Other considerations include the need to improve STEM skills through improved worker education and training, and an increased focus on soft skills, such as communication and adaptivity. Rounding out the list is the impact of automation and AI on the workplace, and expanded use of predictive analytics in both recruitment and retention. (Randstad, 2017 – Note: registration required to download the report)

Leading an Intergenerational Workforce – Looks at employee expectations of leadership and whether they are being met. The survey found that each generation valued different leader competencies, and that no generation’s expectations were consistently being met. Values cited included accountability, and effectiveness at managing stress and at being a coach. (Life Meets Work, 2017 – Note: registration required to download the report)

Disability Management: The Right Support Fuels Workplace Productivity – Provides a snapshot of the link between disability management and employee productivity. This infographic looks at the most common disabilities and accommodations, and provides statistics showing that employees cited a better experience when working with HR on disability management than with supervisors. (Standard Insurance, 2017)

HR – Recruitment, Retention, and Engagement

Employee recruitment, retention and engagement challenges are examined in several new reports, which provide insight into the reasons top-performing employees choose to leave or stay, along with a look at the latest recruitment trends in the healthcare industry. A report examining the impact of automation in the workplace gives employers a snapshot of the future and addresses some of the challenges and goals in adapting to the increasing use of artificial intelligence. At the top of our list is a report on the newest social movement born of the digital and social media age: employee activism.

Employees Rising: Seizing the Opportunity in Employee Activism – Considers the ways in which employers can harness the power of the latest wave in social movements and turn employee activism to their advantage. This survey asked employees about their attitudes and behaviors to help gauge the degree of unrest in the workplace, evaluate the impact of social media on employer reputation, understand the motives driving employee activism, and create distinct profiles using segmentation models so that employers can better understand how activism is affecting the workplace. (Weber Shandwick, 2017)

The Next Generation of Work – Evaluates the impact of automation on the workplace, including generational adaptation, industries most affected, and company expectations in relation to a more agile workforce. The report provides guidance on steps companies can take to prepare for an increasingly automated workplace, such as prioritizing recruiting and learning, adapting to allow for flexible work arrangements, and implementing a culture based on change management strategy. (Guardian, 2017)

2017 Pulse of Talent Report – Explores the reasons that high-performing employees leave or stay at their jobs. This survey of over 1,600 U.S. and Canadian employees found that non-monetary issues were of greater importance in retention, including company values, goals, opportunity for learning and development, and workplace flexibility. The survey also looked at generational differences, finding that Gen X and Millennials were the most positive about their workplaces, with Gen Z and Millennials doing the most job hopping. (Ceridian, 2017 – Note: registration required to download the report)

2017 Healthcare Recruiting Trends Report – Examines job and salary outlook in the healthcare market and finds high turnover, longer times to hire, and among workers, increased pay and high job satisfaction. Employers are relying on recruitment tools to help attract workers, and cited competitive pay as the most important factor. (Health eCareers, 2017 – Note: registration required to download the report)

Retirement Planning

Fees, features and financial wellness are among the themes trending this year in relation to retirement planning. A new survey looks at how well employees understand retirement plan fees, and how that impacts their investment decisions. The rising popularity of auto features is also examined, along with a variety of hot topics related to financial wellness and retirement.

2018 Hot Topics in Retirement and Wellbeing – Looks at employer/employee perspectives on benefits employers should be offering in terms of financial wellness and retirement planning. The survey found gaps in expectations on every issue, including financial wellbeing programs and other benefits, such as student loans, children’s education, and budget and debt management. Issues related to DB and DC plans are also examined. (Alight, 2017 – Note: registration required to download the report)

Start Your Engines: Employees Want Plan Features that Accelerate Retirement Savings – Considers the ways that employers can help employees increase their retirement savings with specific plan features. Key findings include that employees regret not having saved more over the years, and that the majority considered employer retirement plans as one of the most valuable benefits. The report also found that 75% would take a higher employer match over a salary increase, and 8 out of 10 preferring automatic plan features. (American Century Investments, 2017)

DCIIA Fourth Biennial Plan Sponsor Survey – Auto Features Continue to Grow in Popularity – Looks at plan sponsor use of and attitudes toward automatic features. The survey provides useful insights into specific plan design features and why some have been prioritized over others, as well as the impact of such features. It also looks at some of the barriers encountered in adopting additional automatic features, and the reasons some plan sponsors have opted not to implement such features at all. (DCIIA, 2017)

Many Workers Have Limited Understanding of Retirement Plan Fees – Examines how well workers at small and medium-sized firms understand the fees associated with their retirement plans, and the impact of such understanding on their investment decisions. The survey found that while most employees were somewhat familiar with fees, 31% had no familiarity at all, and two-thirds of all workers had not read any investment fee disclosures in the past year. Four out of five workers wanted additional information from employers about plan fees. (Pew Charitable Trusts, 2017)

Retirement Planning – Generational Differences

Retirement expectations, wishes and experiences across the generations are all examined in a variety of new reports and surveys. Surprising similarities regarding retirement hopes and fears come to light, along with a look at how retirement experiences are already playing out among Baby Boomers. Larger trends in retirement readiness over the years are also examined.

Planning for Retirement: A Generational Perspective – Reviews the changes in retirement readiness over the past 30 years, looking at the challenges ahead and offering some solutions. This report offers a look at how retirement readiness has changed over time, and lays out reasons for the drastic differences between older and younger generations. Suggestions to help increase retirement security are made for individuals, employers, and policymakers. (Prudential, 2018)

Wishful Thinking or Within Reach? Three Generations Prepare for “Retirement”– Examines the hopes, expectations, and concerns of the Baby Boomer, Gen X, and Millennial generations regarding retirement. Although most workers had similar dreams about what they would do in retirement (e.g., travel), these were not always realistic, given financial concerns. Retirement fears included lack of financial security, healthcare expenses and premature job loss. Other issues explored include the current financial fragility of workers and employer roles in helping workers prepare for retirement. (Transamerica Center for Retirement Studies, 2017)

Expect the Unexpected: Baby Boomer Lessons on Investing and Retirement – Looks at the specific experiences of Baby Boomers in relation to how reality is matching up with their retirement and investment expectations. Some of the issues examined include costs that have been higher than expected, reasons for retiring earlier or later than anticipated, and adequacy of retirement savings. The survey also looks at the investment history and outlook for Baby Boomers. (Capital Group, 2017)

Statistics

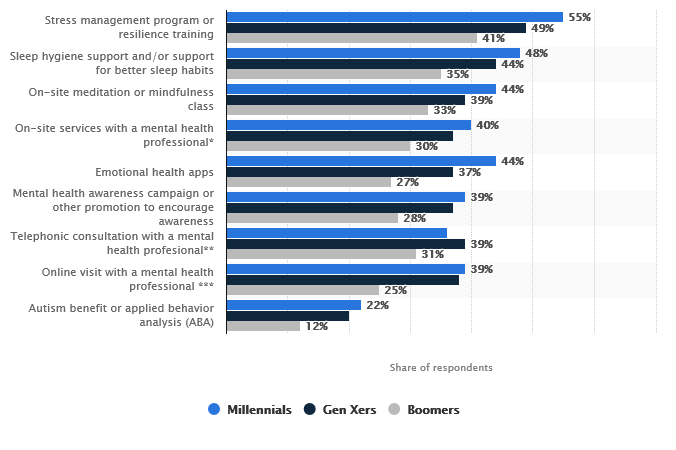

New statistics focusing on voluntary benefits provide a look at the types of educational assistance offered by employers, and a wish list of mental health related services that employees would like to have from third-party providers.

Percent of U.S. Employers Offering Education Benefits – In 2017, more than half of employers offered financial assistance with undergraduate education, and half offered assistance with the costs of graduate school. Fewer employers provided other forms of educational assistance, such as student loan repayment or family scholarships. (Statista, 2017)

Percentage of U.S. Adults Who Would Use Select Mental Health Services if Offered by Employers Through a Third Party, by Generation – Stress management, help with sleep issues, and onsite mindfulness classes were among the most desired mental health benefits in this 2017 survey of three generations of workers. (Statista, 2017)