Volume 40 | Issue 135

![]() Download this FYI Roundup as a printable PDF

Download this FYI Roundup as a printable PDF

Our Fall FYI Roundup features a selection of timely new reports and surveys that provide insight and analysis of HR and employee benefits topics of interest. In this issue, we look at various trending benefits, the open enrollment experience, retention challenges, CEO activism, and the latest surveys on employee benefits offerings and costs. We also review some of the newest reports on financial wellness and retirement savings, impending changes in the workplace as Gen X, Y, and Z start to come together, and visions for the workplace of the future.

Benefits

From a comprehensive review of over 300 types of benefits offered by employers, to the profound implications that benefit offerings have on employees and employers alike, several new surveys provide insight into employee benefits trends. Included is a review of the latest voluntary benefit trend: identity theft protection.

Workforces Report – Employer/Employee Overview – Looks at employer and employee perspectives and attitudes towards benefits trends. Key findings for employees include continuing financial insecurity, with health care costs as the biggest concern and retention strongly linked to benefit offerings. On the employer side, health care costs continue to be a strain, but employers who want to attract top talent and increase worker productivity need to offer diverse major medical options, invest in wellness programs, and make use of consultants and technology in assisting employees. (AFLAC, Lightspeed GMI, 2017 – Note: information can be downloaded from the website)

Employee Benefits Survey – Provides an extensive review of over 300 types of employee benefits across all categories, including health care, wellness, paid leave, financial, relocation, and more. This annual survey of HR professionals also looks at overall trends in employee benefits, and ways that organizations can leverage benefits to contain costs. Included is an appendix with a five-year prevalence trend for each type of benefit. (SHRM, 2017)

State of Progressive Employee Benefits – Explores the increasing interest of offering employees identity theft protection as a voluntary benefit option. Survey results found that almost 68% of HR professionals view it as an important component of an employee benefits package to attract and retain talent. Concerns about preventing loss of productivity due to employee financial stress, and the need to avoid the risk of data breaches from individual employee devices used for business purposes are some of the reasons interest in this benefit is increasing.

Financial Wellness

Employee financial wellness continues to be a significant concern for employers, with several new reports focusing on the impact of financial stress on retirement savings and workplace productivity. Also profiled are workers in the rising gig economy and the particular financial vulnerabilities they face.

American Men and Women Finances Study – Looks at the financial security of middle income workers (annual household income ranging from $35,000 to $150,000). This study finds that while both men and women feel they are behind in saving for retirement; women are three times more likely to say they cannot afford to contribute to an employer retirement plan. Only 20% of women surveyed had emergency savings of $10,000 or more, with women also reporting greater effects of financial stress on physical and mental health. Women were also less likely to have short term disability insurance or supplemental insurance for critical illness. (MassMutual, 2017)

Gig Workers in America – Profiles, Mindset, and Financial Wellness – Looks at the new gig economy and concludes that the model is here to stay. This report evaluates the advantages for employers, including a reduction in benefit costs and the ability to reduce fixed expenses. The report compares “gig only” workers with those who also have part- or full-time employment. Differences in demographics, attitudes, and the type of work most often performed by gig workers, as well as reasons for doing gig work is examined. The report concludes that the gig economy has serious implications for financial wellness, particularly for “gig only” workers, who are more vulnerable to major financial risks. (Prudential, 2017 – Note: report can be downloaded from the website)

Employee Financial Wellness Survey Special Report: Financial Stress & the Bottom Line – Examines the connection between employee financial stress and the cost to employers, and suggests investing in financial wellness programs. This report notes the effects of financial stress on employees, including lost time at work, reduced productivity, and increased health issues. Both Millennials and Gen X employees are depleting retirement funds to cope with financial stress, with student loan debt having a big impact on their ability to meet financial goals. (PwC, 2017 – Note: report can be downloaded from the website)

Health/Health Care

A sampling of new reports and surveys on health care benefits look at the cost of health care in retirement, employee wellness programs as a critical component of recruitment and retention, and a review of the factors that make wellness programs successful. Also included are two annual surveys on employer and employee health benefits costs and medical cost trends.

HSA Account Balances, Contributions, Distributions, and Other Vital Statistics – Draws on an in-house database to analyze individual health savings accounts behaviors, account balances, individual and employer contributions, distributions, invested assets and account-owner demographics. (EBRI, 2017 – Note: report can be downloaded from the website)

Retirement Health Care Costs Data – Reviews over 70 million health care cases and other data to project retiree health care costs. Findings include 5.47% annual inflation of costs, a rate more than double the estimated Social Security cost of living adjustments. The report also looks at the greater costs of retiree health care for women, income replacement ratios, and the difference well-managed health care can make to retiree medical costs. (HealthView Services, 2017)

Employer Health Benefits Survey – Provides data on employer and employee costs for health benefits in large and small firms. This survey covers trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, and employer practices. The 2017 edition includes information on the use of incentives for employer wellness programs, plan cost sharing, and firm offer rates. (Kaiser Family Foundation and HRET, 2017 – Note: both the full report and numerous tables are available for downloading from the website)

Open Enrollment: What Employees Really Want – Looks at employee satisfaction with the benefits open enrollment process and finds that 31% give their employers a “C” grade or lower. HR fared even worse, with respondents being twice as likely to rate HR as “poor” for their handling of the enrollment process. The biggest complaints about the process were constant changes in plans and choices, too much jargon, and not enough time. The survey also found that 72% were willing to sacrifice perks for better health care benefits, although the majority of employees underestimated how much employers spent annually on benefits. (Namely, 2017 – Note: report can be downloaded from the website)

Medical Cost Trend: Behind the Numbers – Provides an annual projection of the growth in employer health care costs. For 2018, costs are projected to rise for the first time in three years, by 6.5%. Lower utilization has countered rising prices, but employees are reaching a limit on their ability to absorb further cost shifting. With potential increases in utilization and continued rising prices, the report concludes that employers need to focus on supply-side management strategies to keep costs down, such as narrower provider networks and value-based purchasing. (PwC, 2017)

State of Corporate Wellness – Evaluates data from more than 8,000 companies recognized as a “healthy workplace” to determine the top trends in effective wellness programs. Examples include the use of metrics, hyper-personalization, and incorporation of wearables, financial incentives, encouraging teamwork, and the incorporation of managers as role models. The report concludes with a list of top ten best practices to encourage employee engagement. (Fitbit, 2017 – Note: registration is required to download the report)

The Business of Healthy Employees – Evaluates the success of employee well-being programs and concludes that such programs are now critical to employee recruitment, retention, and engagement, and that companies must offer a robust array of well-being benefits to become an employer of choice. 90% of employees surveyed stated that well-being programs positively affected work culture, and 62% reported that such programs made them feel more loyal to and engaged with the company. (Virgin Pulse and WorldatWork, 2017)

Leadership

CEOs speaking out on current, hotly debated issues appears to be trending. A recent poll of three generations in the United States provides information about CEO “activists.”

CEO Activism in 2017 High Noon in the C-Suite – Explores the American public’s awareness of and opinions toward CEOs who take a public stand on important societal issues. This update to a similar study performed in 2016 found that generationally Millennials are in favor of CEOs speaking out more than Gen Xers and Boomers, and they are more likely to buy from a company whose CEO speaks out on hot button societal issues. (Weber Shandwick and KRC Research, 2017)

Pay

The issue of pay equality remains a hot button issue; a recent survey provides insight on the progress U.S. HR professionals are doing to alleviate discrepancies in pay.

Quick Survey on US Pay Equities – Looks at how organizations are working to achieve pay equity in the workplace. The data shows that HR professionals are spending more energy than last year on addressing pay equity practices, but making little progress. Common strategies included conducting analyses for bias, and requiring managers to explain pay decisions. A full 20% of respondents had no formal program in place to address the issue. The biggest barriers cited to achievement of pay equity were the expense required and the difficulty establishing criteria to determine what constitutes fairness. (WorldatWork, 2017)

Retirement Trends

Several new studies look at retirement planning from various perspectives, including employee confidence in retirement readiness, the impact of having children on retirement security, and employer efforts to address shortfalls in savings.

The Impact of Raising Children on Retirement Security – Uses the National Retirement Risk Index to examine the impact of raising children on retirement security of working households. (Center for Retirement Research, 2017)

Retirement Confidence Survey – Looks at age comparisons among workers in relation to retirement savings, planning, expected retirement age, and retirement confidence. (EBRI, 2017)

Voluntary Pensions in Emerging Markets – Explores the social and economic challenges faced by emerging markets as demographics shift towards an elderly population and a deficit of younger workers. The report examines the vulnerabilities of state pension systems in light of increasing retirement insecurity, and suggests that the expansion of voluntary pensions could be a solution to the problem. (Global Aging Institute & Prudential, 2017)

All About Retirement: An Employer Survey – Examines perspectives of more than 1,800 employers of for-profit companies of all sizes regarding their views of employee retirement. This survey found that most employers are aware that their employees need to work past age 65 due to lack of retirement savings, yet few are doing very much to help them. Although most employers reported being supportive of older employees, few had plans in place to support a phased retirement. The survey also looks at the current state of retirement benefit offerings, and offers recommendations for employers, policy makers, and workers. (Transamerica Center for Retirement Studies, 2017)

Retirement – Defined Contribution Plans

Defined Contribution Benchmarking Study – Investigates how plan sponsors roles are shifting from financial management to a fiduciary capacity, with an increased focus on financial wellness, demographic and behavioral targeting, and technological tools. The continuing value of DC plans as a recruitment tool, with company match being the number one reason for employee participation is addressed. (Deloitte, 2017 – Note: report can be downloaded from the website)

Talent Management

Attracting and retaining talent continues to be a top concern. Two new reports look at the challenges organizations face in finding skilled workers, and the most common myths surrounding employee turnover, with some advice on how to improve retention.

Economic Outlook Survey – Evaluates opinions of CPA executives at both public and private organizations of all sizes and across multiple industries. The survey data includes outlook for the US economy, hiring plans, industry, region, and business size outlook, and the top challenges facing organizations. 64% of those surveyed were optimistic about the economy, but the biggest challenges include the availability of skilled personnel, and regulatory changes. Employee and benefit costs fell from the top slot during the last quarter to fifth place. (AICPA, 3rd Quarter, 2017)

Do Recessions Accelerate Routine-Biased Technological Change? – Examines how the demand for skills changed over the Great Recession and provides evidence that the economic downturn fostered changes in labor outputs consistent with technological change. (Upjohn Institute, IZA, Yale, 2017)

Retention Report: Trends, Reasons, and Recommendations – Investigates the reasons behind employee turnover, setting out ten distinct “truths,” including some that debunk common demographic myths. The report acknowledges that there is increasing competition for workers in a shrinking talent pool, confirming that employees are now in control and high turnover leads to higher costs for employers. Most turnover happens during an employee’s first year, with career development being the biggest reason for leaving, but the report notes that the reasons for staying may not be the same as the reasons for leaving. Finally, the report states that turnover is preventable and offers advice for improving employee retention. (Work Institute, 2017 – Note: registration is required to download the report)

Workforce Trends

As the nature of work continues to become more entrenched in technology, the number of independent workers is also predicted to grow. Two new reports look at the future of independent work and the implications technological advances have for collaboration.

Looking Forward: What Will the Independent Workforce Look Like in 2027? – Reviews data from multiple sources to make predictions about the state of the independent workforce in ten years. The report predicts that 58% of Americans will be independent workers, or have been independent at some point by 2027, with many of these workers cycling in and out of regular employment. A focus on results achieved rather than the worker, and the teaming of independents are some of the report’s other visions for the future. (MBO Partners, 2017)

Collaboration Unleashed: Empowering Individuals to Work Together from Anywhere – Examines trends in worker productivity within the context of remote work, automation tools, and employer-provided technology. This survey found that workers had high expectations for employers to provide technology allowing for remote work, with 74% willing to switch employers if offered the possibility of working remotely at another position, even at the same salary. While 83% of workers use technology for virtual collaboration, 78% reported experiencing technical problems that affected their ability to collaborate effectively, and nearly one quarter were concerned about automation eventually replacing their jobs. (Softchoice, 2017 – Note: report can be downloaded from the website)

Millennials Attitudes on Work, Retirement, and Investing – Looks at Millennials’ attitudes in light of a new labor market where pensions and long-term job security have become a thing of the past. Having embraced the gig economy, Millennials value flexibility and a faster pace, but still value loyalty to employers. Even though they are accepting the move towards individual responsibility for retirement security, Millennials are focused on getting the best possible financial and social benefits from employers. (The Capital Group, 2017)

Gen Z’s future brighter than previous generations – Provides insight into Gen Z sentiment regarding the future of work, finding that nearly two thirds of those surveyed were optimistic about their prospects for financial security and happiness at work. New technologies, inclusiveness, the potential for career progression, and job satisfaction are top priorities for Gen Z in the workplace. Although Gen Z is considered different from its predecessor generation, the Millennials, 67% of those surveyed indicated that they would prefer to have a millennial manager over a Gen X or Baby Boomer. (Ernst & Young, 2017 – Note: These are key findings only)

Generation Series 2017: How to support the workplace goals of Generation X, Y and Z – Evaluates survey responses from 18,000 professionals and students in 19 countries from three generations to determine their different goals and values in relation to work. Leadership ambitions were important globally across all generations, but especially among those in Gen Y in the United States (77%). More than 70% of all generations globally cited flexible working arrangements as an important factor in employment, and while most of Gen X and Y believed that digital technology was important to their work, only 40% felt that their employers had sufficient capability. Finally, while fitting in at work was more important to Gen Y and Z, Gen X was most concerned about being unable to enjoy retirement or losing job security. (Universum, 2017 – Note: the e-book can be downloaded from the website)

Workplace

New studies focus on working conditions for employees today and the workplace of the future, envisioning various possibilities and directions in light of changing technology and demographics.

Workplace of the Future: The Competing Forces Shaping 2030 – Looks at four possible workplace scenarios for 2030, including one that focuses on consumers and the demand for innovation; a capitalist global corporate workplace; a “green” corporate workplace based on social responsibility; and a workplace oriented towards the human factor and community businesses. (PwC, 2017 – Note: report can be downloaded from the website)

Navigating the Future of Work – Identifies three forces shaping the future of work, including technology, demographics, and “the power of pull,” or the availability of global talent markets and the empowerment of customers. The report looks at the implications for individuals, organizations, and public policy, including the transformation of the nature of work itself and the shifting relationship between employers and employees. (Deloitte Review, 2017)

Working conditions in the United States – Analyzes data from a 2015 survey of over 3,000 American workers. Findings include a high rate (nearly 20%) of employees reporting a hostile or toxic work environment, with almost one-half saying they worked on their own time to fulfill the demands of their job. Only 38% felt there was hope for advancement. On the bright side, more than half felt they had supportive bosses and good friends at work, and four out of five agreed that their job met the definition of “meaningful” at least some of the time. (Rand, 2017 – Note: report can be downloaded from the website)

Statistics

From wellness programs to defined benefit plans, recent statistics are available for some of the most pressing issues affecting employers and employees today.

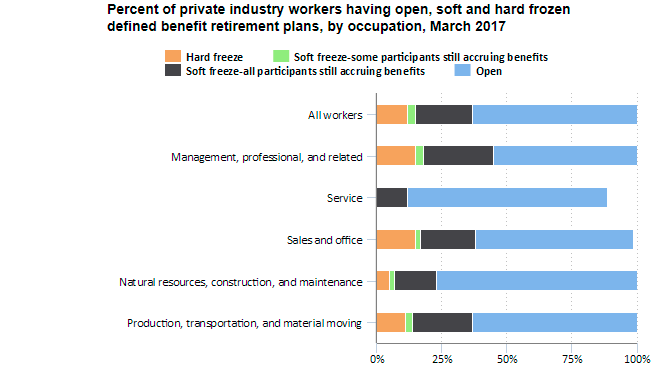

63% of Defined Benefit Retirement Participants in Plans Open to New Participants – Provides statistics for private industry workers having open, soft, and frozen defined benefit retirement plans, as of March 2017. The occupational groups with the highest percentage of workers in open plans were in services, natural resources, construction, and maintenance:

Source: BLS (U.S Bureau of Labor Statistics), 2017

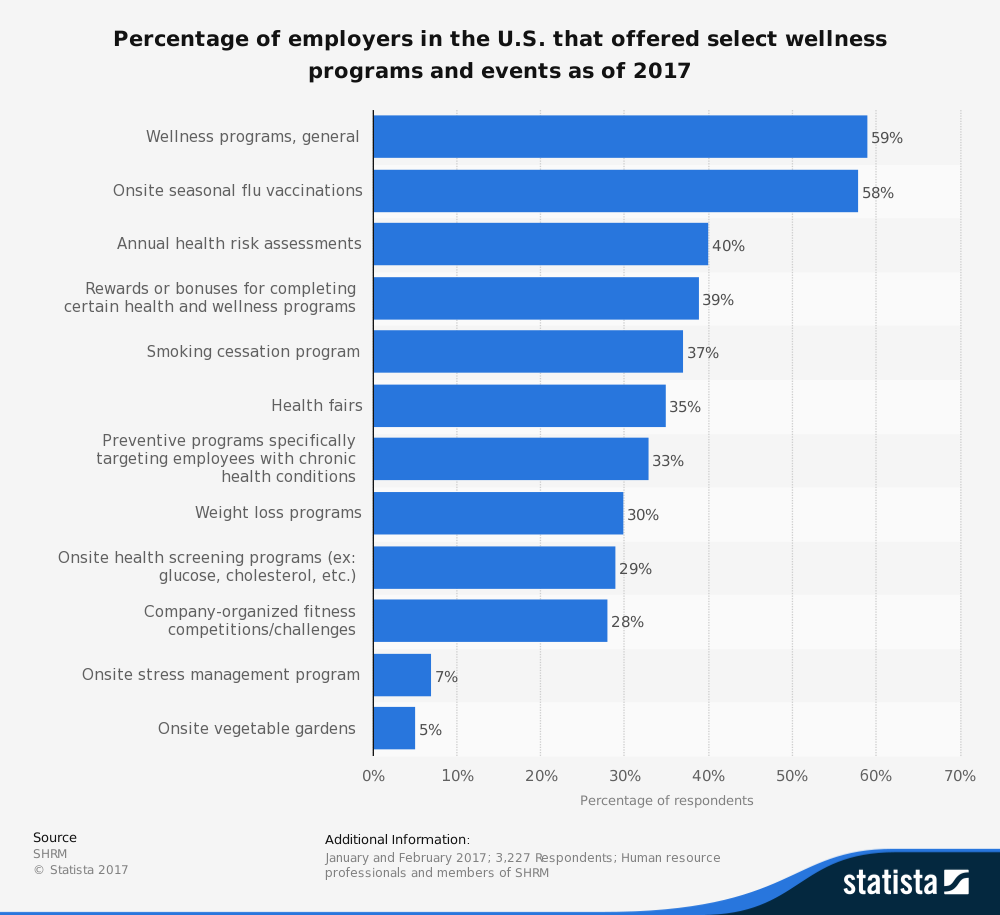

Statistics for 11 types of wellness programs offered by employers, ranging from onsite flu vaccinations (58%) to weight loss programs (30%), to onsite vegetable gardens (5%) are provided below: