Volume 01 | Issue 04

Download this FYI as a printable PDF

This FYI provides details on the recent draft regulation amending the regulation to Quebec’s Supplemental Pension Plans Act and discusses the impact of the proposed changes on affected plans.

Overview of draft regulation

On July 3, 2019, a draft Regulation amending the Regulation respecting supplemental pension plans (draft) was published in the Gazette officielle du Québec for a 45-day comment period. The draft:

- Revises the scale used to determine the target level of the stabilization provision

- Allows plan sponsors to diversify their plan’s fixed income portfolio

- Changes certain fee rules, including the maximum annual information returns (AIR) fee

- Changes the required content of partial actuarial valuation reports

Changes to the stabilization provision

As part of Quebec’s move from solvency funding to enhanced going concern funding for defined benefit (DB) pension plans, the province introduced the requirement that DB plans establish and fund a stabilization provision. The target level of each plan’s stabilization provision is calculated based on the rules in the Regulation respecting supplemental pension plans and is based on a scale that varies depending on a plan’s long-term asset mix targets, as set out in its investment policy.

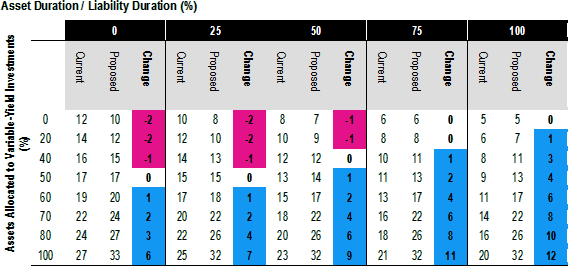

The draft proposes changing the scale effective December 31, 2019. The current and proposed scales, and the differences between them, are shown below.

As the investment portfolio of most DB plans typically features 40% to 60% of assets invested in fixed income, with asset durations ranging from 0% to 50% of the liability durations, the proposed changes will not have much impact. Such plans will see the target level of their stabilization change between -1% and 2%.

However, the proposed changes will have a more significant impact on plans that are heavily invested (i.e. 60% or more) in variable-yield products, especially plans that are well duration matched. For example, a plan that is invested 70% in variable-yield products will see their stabilization level decrease by only 2% by having a fully duration matched portfolio (i.e. from 0% to 100% asset duration / liability duration), instead of 8% with the current scale.

Under these new rules, the target stabilization level for well immunized plans that have a high allocation to variable-yield products will increase by as much as 12%, hindering the advantage of using derivatives to match the duration of assets and liabilities. This will have a significant impact on required contributions for the plans since it will increase the current service contributions and may create an additional deficit that would need to be funded.

Facilitating asset diversification

The draft also proposes taking unquoted private debt into account as fixed income investments, to a maximum of 10% of the plan’s assets, when certain conditions are met. These include annual certifications of this strategy by the plan’s asset manager and an attestation from the pension committee in the plan’s actuarial valuation report that the required certifications were obtained for the fiscal year of the report and each fiscal year following the last report.

This change, scheduled to take effect December 31, 2019, will allow for better diversification of plan investments and will potentially reduce the target level of a plan’s stabilization provision.

Changes to certain fees

The draft proposes the following fee changes:

- Effective December 31, 2019, the upper limit on AIR fees will increase from $100,000 to $150,000, with indexed increases thereafter.

- If and when the draft takes effect, additional fees payable for the notice of solvency required under section 119.1 of the Supplemental Pension Plans Act, as well as for an actuarial valuation report that was filed on the date when a notice of solvency was required, will be eliminated.

- If and when the draft takes effect, the additional fees associated with delayed report filing reports will be eliminated, in certain situations.

Other changes

The draft also proposes streamlining the content of partial actuarial valuations tied to plan amendments and to annuity purchases by private sector pension plans. For example, in lieu of calculating the target level plan’s stabilization provision, the report can instead include the target from the last valuation report.

In closing

Plan sponsors will need to re-examine their investment strategies before the changes to the stabilization rate scale take effect to determine whether it is necessary or advisable to adjust their plan’s investment portfolio. Sponsors should also consider whether they wish to make use of the new diversification opportunities provided by the changes to the treatment of unquoted private debt. To the extent any changes are made, associated revisions to the statement of investment policies and procedures (SIPP) will be required. Large plans should also be prepared to pay a higher fee when filing their next AIR.

For more information on the draft, how it may impact your plan, and how you can manage those impacts, talk to your Buck consultant or contact the Knowledge Resource Centre at talktous@buck.com or +1 866 355 6647.