Millions of defined contribution (DC) plan participants have access to target date funds (TDF), giving them the benefit of a professionally managed asset allocation either to or through retirement.

Underpinning a TDF’s asset allocation is the glidepath which charts the essential course of moving from higher risk to lower risk asset classes and is aligned with participant lifecycles. However, suboptimal savings rates during an individual’s working years and rising income needs in retirement – along with the ever-changing meaning of “retirement” – has moved the industry to evolve. How are TDF glidepaths adapting to meet these challenges?

What’s at stake

Recent U.S. Census data indicates that Baby Boomers, currently about 73 million, will be age 65 or older by the year 2030. Nearly 84 million private-sector workers participate in a DC plan, which has contributed to the dramatic shift in DC plan assets, currently about 64% of US pension assets.

Combine these statistics with research noting the desire of more than half of DC plan participants to keep their money in their employer’s retirement plan, and it’s plain to see why a glidepath’s focus on what happens after age 65 has become as important as what happens throughout a lifetime of investment. Fortunately, we now have more than two decades of performance data and with passage of PPA 2006, 15 years of broad plan sponsor adoption of TDFs as the preferred qualified default investment alternative.

The “to and through” debate

The 2008/09 Global Financial Crisis heightened plan sponsor awareness of the risk level inherent in TDF glidepaths, particularly for those participants nearing and in retirement when some investment drawdowns ranged from -10% to -23% in 4Q2008. Simplistically perhaps, the labels of “managed-to” and “managed-through” became more widely used in an industry effort to easily categorize managers as more conservative (based on glidepath rolldowns that stopped at age 65) vs. more aggressive (based on those that continued past normal retirement age). An additional notion was that plan sponsors who chose a managed-to or managed-through glidepath made an assumption regarding participant distribution behavior, i.e., taking a distribution of their plan balance at retirement vs. retaining their account balances in-plan.

TDF methodology and implementation has continued to evolve this thinking. As we know from Buck’s continuing due diligence on TDF managers, the focus on asset allocation and derisking of glidepaths has become even more nuanced and sophisticated. Plan sponsors and their participants were again reminded of this at the outset of the COVID pandemic. In the 1Q2020, some TDF portfolios for those participants 10 years or less from retirement experienced investment drawdowns of -14% to -17%.

Ultimately, a key focus of a TDF manager is how best to design a glidepath that can help lessen a participant’s longevity risk (the risk of outliving one’s assets) in retirement, combined with acceptable levels of volatility from the underlying investments.

Glidepaths mature over time along with participants

While the saying, “life is a journey, not a destination,” is an oft-quoted adage to achieving a balanced life, in TDFs it’s all about the destination, more commonly referred to as “the landing point.”

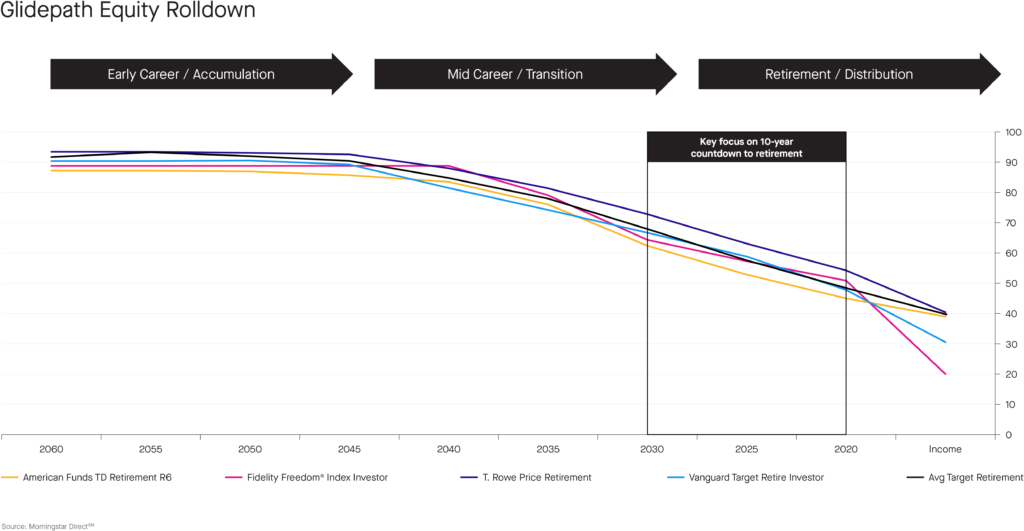

Consider the following illustration that tracks the most significant component of risk in a TDF glidepath – equities – among four of the largest TDF mangers in the marketplace, implemented on both active and passive bases (click image to enlarge).

While each of these managers shares the commonality of a downward sloping path that derisks over time, the landing point and underlying compositions vary by U.S. and non-U.S. equity exposure across developed and emerging markets, investment styles, and market cap spectrum.

Variations in the level and type of fixed income allocations (the complement to equities to help generate income and reduce risk in the later vintage years of a glidepath) are also becoming progressively complex. It’s not just about the transition from higher-risk equities to lower-risk fixed income. It’s about the range and types of securities held within each of those investment categories.

One of the largest passive TDF managers recently announced that in the future they will be disaggregating the ubiquitous U.S. Aggregate Bond fund into five different components with varying credit and interest rate exposures to better meet participant objectives, and enhance the counterweight to equity risk.

Another manager recently announced a bifurcated approach as a participant’s TDF investment moves towards its landing point – to a different fund and an alternative landing point with higher allocations to equities driven by the desire, or need, for greater returns through retirement. (Participants will have the ability to choose between two different landing points.)

An objective focused on a trinity of risks

Regardless of the simplicity or complexity of glidepath implementation, the goal is to provide participants with a greater level of diversification that evolves over time than many might be able to achieve on their own, to address three key risks:

- Market – the volatility or drawdown of the portfolio

- Inflation – failing to maintain purchasing power of assets

- Longevity – outliving accumulated assets

What’s the optimal glidepaths to support these objectives for plan participants? In our destination analogy, there are a series of key road markers that should drive plan sponsors’ decision on the appropriate landing point for their participants. These include:

- Contribution rates

- Wage growth

- Duration of participation

- Retirement time horizon

- Existence of other retirement programs

Since there is no single glidepath solution, these factors should be considered on a plan-by-plan basis. Every target date manager has developed an argument to support their position. By incorporating these and other fund implementation elements in our objective analysis when optimizing for risk and return over the retirement time horizon, we’re able to assess a glidepath’s rolldown to its final landing point, and how it’s positioned to best meet the needs of a plan sponsor’s demographic.

Perpetually focused on the future

With passage of the PPA of 2006 and the safe harbor status afforded by QDIA regulations, TDFs have played an increasingly prominent role in the overall investment structures of DC plans. The SECURE Act, passed in December 2019, eased the liabilities that plan sponsors could face when offering annuities to participants. It also opens the door for annuities within TDFs.

Even as we consider the impact to TDFs against recent market events driven by the pandemic, it’s important to maintain a forward-looking approach grounded in sound evaluations of glidepath construction, the key risks and the unique differences in a managed-to vs. managed-through designed to meet the evolving nature of participants’ needs at retirement.

Notable development

In May, key congressional leadership wrote to the head of the Government Accountability Office (GAO) asking that the agency review the use of TDFs in DC plans. They asked the GAO to answer key questions including:

- What steps have TDF providers taken to mitigate the volatility of TDF assets?

- How does the asset allocation and fee structure vary across TDFs?

- Are participants “sufficiently aware of the cost and asset allocation variation among TDFs”?

- What are possible legislative or regulatory options that could augment the protection of plan participants nearing retirement or who are retired and also achieve the intended goals of TDFs?

No response had been issued as of this publication date.

Sources: Invesco LTD, 2021 Defined Contribution Language Study–June 2021, J.P. Morgan Asset Management, Retirement by the Numbers–October 2021, the Employee Benefit Research Institute, the Society of Human Resource Management, and the Thinking Ahead Institute, Global Pension Assets Study, October 2020.

This article is for informational purposes only and is not a recommendation for any specific investment product, strategy, plan feature or other purposes. The opinions and information contained herein should not be construed as Legal or Tax advice. All information that is obtained from external sources cannot be guaranteed but is provided by those who have been proven to be credible, reliable, and recognizable.