Volume 2019 | Issue 25

Download this FYI as a printable PDF

In order to provide further context to its latest annual funding statement, the Regulator has published its analysis of the expected positions of defined benefit pension schemes with valuation dates between 22 September 2018 and 21 September 2019 (Tranche 14 schemes). Overall, the Regulator states that it believes that schemes undertaking valuations at 31 March 2019 will find their funding levels and deficits have marginally improved in comparison with those reported three years ago. However, deficits have not generally improved to the extent that the Regulator would have expected over the inter-valuation period and there are a significant proportion of schemes that might find the discussions on the current valuation difficult. In particular, the analysis of schemes by covenant and funding strength highlights the marked difference in how far the Regulator is expecting the funding plan to move for those schemes with strong employer covenants compared to those sponsored by those in the bottom 40% of employers. The message from the Regulator has therefore not changed since last year, namely it is likely that recovery plans will not be on track to remove the deficit revealed at the previous valuation. If trustees want to retain the same end date to their current recovery plan, deficit reduction contributions (DRCs) will need to be increased. The increases that the Regulator considers necessary are very significant, with over 70% of schemes potentially requiring a more than a doubling of DRCs, if they are to retain the existing recovery period. This FYI summarises some of the key points to come out of this latest analysis.

Market indicators

The Regulator notes the significant fall in gilt yields since March 2013 while inflation expectations have remained broadly unchanged. As has been the case for a couple of years, this is likely to have a significant impact on expected returns across various asset classes. All else being equal, the Regulator would again expect that most Tranche 14 schemes will set funding strategies based on lower expected investment returns from most asset classes than at their last valuation. As a result, most schemes are expected to have a larger reported value on their liabilities at their valuation date than would have been forecast three years ago. Over the last three years, returns have been significantly positive for most asset classes. This is mainly due to strong asset returns in 2016. Most asset classes returned significantly more over the period March 2016 to March 2019 than December 2015 to December 2018. This is primarily due to the positive returns on these asset classes over the period December 2018 to March 2019, coupled with relatively low or negative returns over the period December 2015 to March 2016. Hedge funds and property indices have seen relatively low returns over the three years to 31 March 2019, and negative returns over the three years to 31 December 2018.

Aggregate funding of defined benefit schemes

In the three years to 31 December 2018, DRC’s, coupled with better than expected asset returns and updated assumptions for future mortality improvements, have not been enough to offset the increase in liabilities, due to the change in market conditions and the reduction in relative expected outperformance. The Regulator estimates that the aggregate deficit of Tranche 14 schemes could have deteriorated slightly from three years ago. However, the position may be slightly different for Tranche 14 schemes at the two most common valuation dates of 31 December and 31 March. Whilst the aggregate deficit of Tranche 14 schemes as at 31 March 2019 could have reduced slightly from 3 years ago, the position for Tranche 14 schemes with a 31 December 2018 valuation is bleaker. Most asset classes did better in the period from March 2016 to March 2019 than they did in the period 31 December 2015 to 31 December 2018.

Employer profitability, balance sheets and dividend payments

A key consideration for trustees and employers when setting their scheme funding plans is the strength of the employer covenant. The Regulator’s analysis suggests that the majority of employers have seen an increase in the nominal value of their profits and balance sheets over the last three years. Unsurprisingly the most significant increases in profit came from employers with stronger covenants. It should be noted, however that there is a wide distribution of how profits have changed across, and between, individual employers, and there remains a considerable proportion of pension schemes where the sponsors have experienced a decline in profits over the period. There are 48% of schemes with employers reporting a decline in profits over the period. For the group of FTSE350 companies that paid both DRCs and dividends in each of the previous six years, the Regulator has seen, at the median level, the ratio of dividends to DRCs increase from 9.2:1 to 14.2:1. This is mainly driven by the significant increase in dividends over the period, without a similar increase in contributions. FTSE350 companies that sponsor a defined benefit scheme, and which paid dividends but no DRCs, rose from 8% in 2012 to 16% based on the latest accounting information. While the number of FTSE350 companies which paid DRCs and no dividends remained flat at under 7%. Non-FTSE350 public companies that sponsor a defined benefit scheme, and which paid dividends but no DRCs rose from 8% in 2012 to 12% based on the latest accounting information. While the number of non-FTSE350 companies which paid DRCs and no dividends remained relatively flat at 29% up 1% from 2012. For non-FTSE350 public companies that paid DRCs and at least one dividend over the period since 2012, the ratio of dividends to DRCs has increased from 3.7:1 to 4.9:1.

Implications for scheme funding

Many schemes are likely to have similar deficits to those revealed at their previous valuation and for schemes with 31 December 2018 valuations the deficits may have increased. It is therefore likely that trustees will need to amend their recovery plans as current plans will no longer be on track to remove deficits. The Regulator’s analysis highlights that affordability may have increased for a number of employers, which means that they may also have a greater number of deficit management strategies available to them than before. Furthermore the increase in dividends suggests an increase in affordability which could be used to shorten recovery plans instead.

Potential impact on DRCs

The Regulator suggests that about 30% of schemes would be able to retain their DRCs at the same level or less, either because of an improvement in their funding position or, for those schemes nearing the end of their recovery plan, the possibility of a moderate increase in the recovery plan length. Around 50% of schemes would need an increase of up to 100%, and the remainder (c20%) would need to more than double their DRCs to retain their current recovery plan end date. However, the Regulator’s further examination of the schemes in this last category showed that the majority of them are supported by strong employers who will have greater ability to increase contributions.

Employer affordability

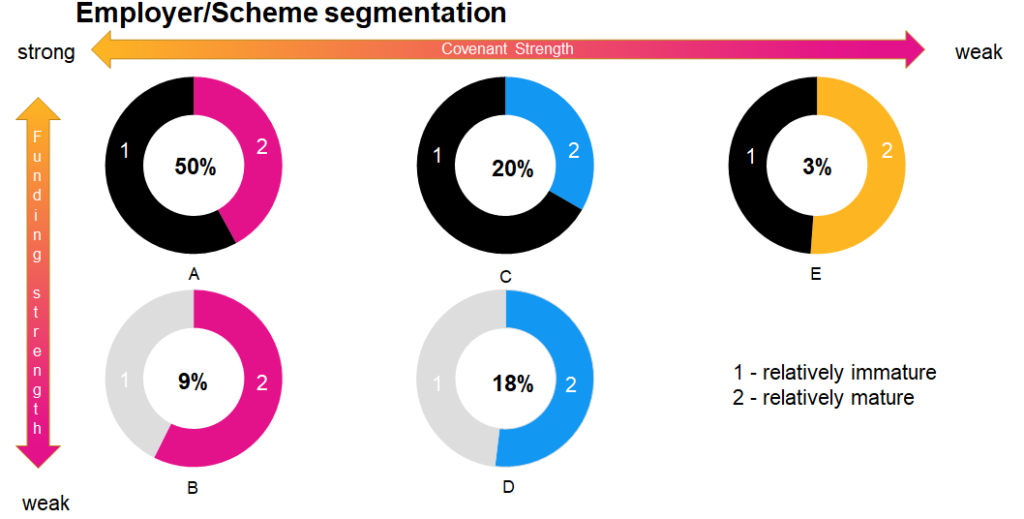

A key factor for trustees and employers when agreeing an appropriate recovery plan is the affordability position of the employer, recognising that what is affordable may be affected by the employer’s plans for sustainable growth. The Regulator’s annual funding statement segments defined benefit pension schemes into five broad categories depending on the employer and funding characteristics. The analysis below sets out the percentage of Tranche 14 schemes that fall into each category.

Comment

Comment

We expect that schemes with strong employer covenants are likely to find increasing pressure to pay off deficits in the very short term. This is clearly a focus of the Regulator, in light of recent high profile scheme failures, and the Regulator’s call for greater powers to target employers deemed to not be sufficiently meeting their pension obligations. The Regulator highlights the increased affordability many sponsors may have with regard to their defined benefit pension schemes, in light of increased dividend payments over recent years and sponsors should be mindful of what the Regulator has to say about this. In addition, around half of those schemes with less strong employer covenants have been identified as having a funding plan that is not in line with the Regulators expectations of where they should be. The consultation into the appropriateness of the current funding regime is likely to be postponed for long enough to not impact many schemes in Tranche 14. However, the Regulator’s analysis and statement of current expectations is very clear and could result in some difficult discussions. Negotiations and strategies should be being considered early by all parties.