Volume 41 | Issue 101

Download this FYI as a printable PDF

A court in New York is being asked to certify a class action lawsuit served on MetLife earlier this month. This was followed by a nearly identical lawsuit in Texas served on American Airlines as well as another in New York served on PepsiCo. The first two suits fault the use of an old mortality table in determining optional forms of distribution; the PepsiCo suit faults simplified option factors. Additional lawsuits are likely to follow. These cases highlight the possible need to periodically re-evaluate the reasonableness of factors currently used in ERISA pension plans.

Background

Defined benefit plans subject to ERISA Section 203 and the parallel qualification requirements of IRC Section 411 must meet specific “vesting” rules.

One IRS regulation on the vesting rules specifically notes:

“Nonforfeitability. Certain rights in an accrued benefit must be nonforfeitable to satisfy the requirements of Section 411(a). This section defines the term “nonforfeitable” for purposes of these requirements. … Certain adjustments to plan benefits such as adjustments in excess of reasonable actuarial reductions, can result in rights being forfeitable.” (Emphasis added.)

The highlighted phrase is generally viewed as the key regulatory guidance influencing plan early, late and option factors. If early retirement factors are too steep or late retirement factors too paltry, for example, then this rule is violated. Additional requirements that address actuarial equivalence are the requirement that other options not be more valuable than the plan’s qualified joint and survivor (QJSA) benefit, the actuarial adjustment rule in IRC Section 411(c)(3), the post-normal retirement age increase required by IRC Section 411(b)(1)(H), and the post-age 70½ retirement increase required by IRC Section 401(a)(9). However, despite guidance issued on this long-standing regulation, the IRS has not specified a range of acceptable interest and mortality rates that may be used for these purposes. They have established rates for other purposes such as the standard interest and mortality used for nondiscrimination evaluations, and the Code establishes the Section 417 applicable interest rate and applicable mortality table as a minimum basis for certain options such as lump sum distributions. But there is no standard for the selection of assumptions used for determining benefits payable under optional forms of payment.

Complaints filed about option factors

Early this month, a class action complaint was filed in the U.S. District Court for the Southern District of New York asserting that Metropolitan Life and plan fiduciaries had breached their ERISA fiduciary obligations by using outdated actuarial factors to calculate options that were defined as the actuarial equivalent of the plan’s normal form of benefit (generally a five year certain and life form in the MetLife plan).

The plan uses a 6% interest rate and the 1971 Group Annuity Mortality Table for Males (1971 GAM table), set back one year for participants and five years for beneficiaries. The class asserts that the table is inherently unreasonable because of its “outdated accelerated mortality rates” developed over 45 years ago, when people had much shorter life expectancies. “The combined result of using a 6% interest rate and the 1971 GAM mortality table is that defendants do not provide actuarially equivalent alternate annuity benefits, but instead provide alternate annuity benefits that are materially lower than the benefits that would be a true equivalent to default benefits. Accordingly, defendants caused plaintiffs and class members to unknowingly forfeit and lose part of their vested benefits due under the terms of the plan.”

The class members want MetLife to reform the plan for future calculations, recalculate years and years of benefits in pay status, and pay amounts improperly withheld. The court documents point to using variable interest rates such as “segments of short-term, medium term and long-term expectations pertaining to each future payment.”

The same law firm followed the MetLife action about a week later with a suit in a Texas district court complaining of American Airlines use of 5% interest paired with the 1984 Unisex Pension (UP84) mortality table. This second suit raises comparable issues and demands.

Back in the U.S. District Court for the Southern District of New York, on Wednesday the firm filed suit complaining that the simplified factors used in the PepsiCo Salaried plan are “lower than the conversion factor that would be generated using reasonable market mortality tables and interest rates.” The demands match the earlier filings.

What’s it worth?

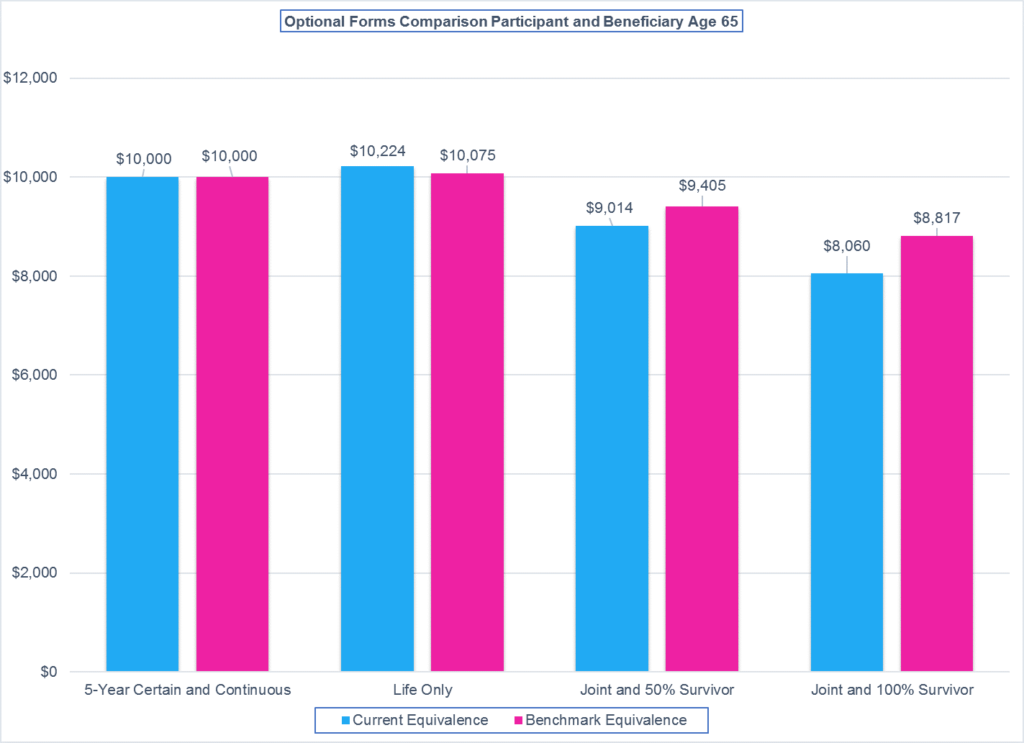

For illustration purposes, this graph shows the difference in various annual annuity benefits for a $10,000, five year certain and continuous annual pension at age 65, with a spouse at the same age, based on MetLife’s assumptions compared to 6% interest with the 2019 Section 417 applicable mortality table.

Likely outcome?

Clearly it is too soon to guess how the courts will decide, whether parties will appeal to the circuits’ appeal benches, or to the Supreme Court. Or whether the parties will settle in some fashion. This is not a topic normally seen in our courts. Interestingly, however, a 2007 case (McCarthy v. Dun & Bradstreet Corp) decided by the Second Circuit Court of Appeals (same circuit as the MetLife and PepsiCo cases) addressed the use of a 6.75% interest rate for determining early retirement reductions (mortality rates were not considered due to procedural glitches). In that case, the court concluded that the plan’s rate was not unreasonable as determined at the time the rate was set and that “ERISA does not specifically require that retirement plans periodically adjust their actuarial interest rates.” This may offer a precedent for the MetLife and PepsiCo cases, though not so much for the American Airlines court.

Buck comment. Reasonability at the time the rate was set may attract challenges down the road. Despite this one district court decision, while IRS seems reluctant to provide a specific range of reasonability, representatives have informally commented that the evaluation is a current examination. Though an unrelated topic, the Supreme Court held in Tibble v. Edison International that plan fiduciaries have a continuing duty — separate from the duty to exercise prudence in selecting investments — to monitor and remove imprudent investments. Some may find a parallel here.

What’s a plan sponsor or fiduciary to do?

This is not simply a matter of saying that the factors are set by the plan sponsor as “settlor” and therefore not subject to a fiduciary challenge or that a fiduciary has an obligation to administer a plan in accordance with ERISA despite what the plan document may say, since it is not clear what it means to operate in accordance with ERISA when it comes to acceptable factors. Although it may be tempting to take a “wait and see” approach, courts have generally found that defending fiduciary decisions is not necessarily a matter of getting it “right” as much as about process. Performing and documenting the process taken to evaluate the acceptability of actuarial equivalency factors may not stop a lawsuit but may go far in insulating the fiduciary from personal liability for an ERISA violation.

Thus, plan fiduciaries should consider evaluating how the plan’s current factors compare to a range of rates that reflect current mortality and interest. Armed with this information, a decision can be made to make changes or leave current factors in place until courts, legislation, or regulations fashion some range of acceptability. Because actuarial adjustments cut two ways, if they’re not reasonable, either the participant is paid too little or the plan is paying too much!

In closing

To avoid facing challenges in court over the reasonability of actuarial factors, plan sponsors and fiduciaries may wish to evaluate plan factors against a current reasonable standard. This is merely one issue among many in the vast array of ERISA requirements for employer-provided retirement plan benefits. Periodic review of plan provisions and operations can demonstrate fiduciary diligence to ERISA duties.