‘Tis the season to predict next year’s benefit plan limits. Annual COLA adjustments for most limits are measured using the CPI-U announced by the Bureau of Labor Statistics for July, August, and September. BLS announces these a few weeks after the indicated month ends. The September rate will be released this year on October 22, at which time the guessing will be over.

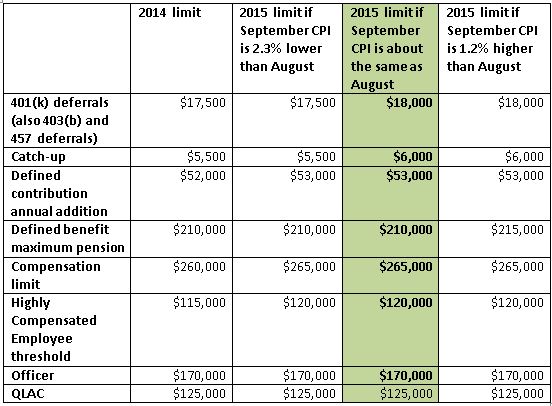

With both the July and, as of September 17, August rates in hand, there is little doubt that we will see increases in most of the benefit limits for 2015. Interestingly, the August CPI-U retreated slightly from the July level, underscoring the fact that reductions do happen. But we would need a 2.3% (over 25% annualized) retrenchment for September to prevent any of the increases. And we would need a 1.2% (over 12% annualized) increase to move the defined benefit limit to its next notch. Both scenarios are unlikely. Here are select predictions:

A new limit appears on the list with the debut of the qualifying longevity annuity contract (QLAC) with its $125,000 cap. See our July 10, 2014 For Your Information for a discussion of this new option. The QLAC will be adjusted in $10,000 steps. So we need an increase in CPI of 8% (10,000/125,000) before the limit jumps to $135,000. Thankfully, prices are not rising at anywhere near that level so the QLAC value will stay at the $125,000 mark for the near future.

Marjorie Martin, EA, MAAA, MSPA Principal, Knowledge Resource Center