The Office for National Statistics (ONS) released the April 2023 inflation figures on 24 May 2023, showing that CPI rose by 8.7% in the 12 months to April 2023. Whilst this is lower than the March 2023 figure, what is worrying is that Core CPI (which excludes energy, food, alcohol and tobacco) rose to 6.8% for the same period compared with 6.2% for the year ending March 2023. The ONS noted that this is the highest rate since March 1992. So, whilst CPI is falling, there is evidence that inflationary expectations are becoming embedded and aren’t just a one-off price adjustment due to a supply side shock (Ukraine).

Adding to these concerns are recent comments to the House of Commons Treasury Committee by Andrew Bailey that the Bank of England is facing real challenges in setting monetary policy to deal with the current inflationary environment.

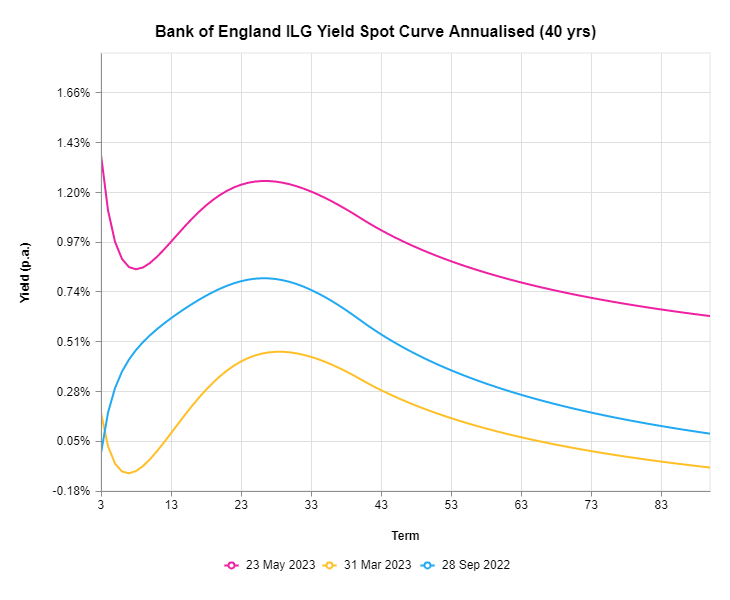

It is against this background that we have seen real yields rising as shown in the chart below.

Note: ILG – Index-linked Gilts. Spot curve reflects the annualised cumulative rate of return adjusted for expected inflation each year for the relevant term. After year 40, the underlying forward rate is set equal to the rate in year 40.

Source: Bank of England, Buck.

Key points to note:

- The current index-linked gilt spot curve (pink line) is higher across all terms than it was on 28 September 2022 i.e., immediately after the Bank of England’s initial intervention during last years’ LDI crisis.

- Whilst real yields fell between the end of Q3 2022 (blue line) and end Q1 2023 (yellow line), there has been a material reversal during Q2 2023 to date.

- The above dynamics reflect the interplay between nominal yields and inflation expectations. Spot inflation expectations have fallen back since 31 March 2023, having risen at longer terms in the prior period.

Against this background and the risk of further rate increases, I would highlight the following for defined benefit pension schemes with leveraged LDI exposures:

- The importance of undertaking the resilience testing as recommended recently by The Pensions Regulator – click here to see our recent blog “LDI resilience: The journey continues”.

- Trustees should make sure appropriate collateral waterfalls are in place and have agreed the actions to be taken to top them up when cash calls are made (assuming trustees wish to retain their liability hedges).

- Where cash is called as part of a deleveraging event, deliver it as soon as practical rather than waiting to the target due date in case this is brought forward because of further rate increases.

- If cash calls arise that require the sale of assets other than cash, consider carefully which assets to sell taking account of market valuations and the downside risks associated with the current market environment. In doing this it is important to distinguish between actions viewed as short-term risk mitigation and longer-term strategic decisions which could affect the funding and journey plan. There are ways to mitigate any longer-term funding impacts that should be considered by trustees, consulting with the sponsor as appropriate.

Carl Hitchman

Head of Investment Consulting / Chief Investment Officer

Note: Information contained in this article has been sourced from the Bank of England and the Office for National Statistics under the Open Government Licence v 3.0. It is also sourced from the UK Parliament website under the Open Parliament Licence v3.0

Important Notice: This article is for Professional investors only and was written on 24 May 2023. The article is generic in nature and should not be regarded as providing specific advice or a recommendation of suitability. No action should be taken without seeking appropriate advice, taking account of how the market environment has changed since the date of this article. There can be no guarantee that any opinions expressed herein will prove correct. This article is a financial promotion and was approved by Buck Consultants (Administration & Investment) Limited, 24 May 2023.